Hi gang. Bubble’s documentation has been great for most things, but I’m finding the information on Stripe integration to be less great. Lots of info, but it’s almost too much. And a lot of it I suspect does not apply to my needs.

My situation:

- I’m not a marketplace. Billing involves just me billing my customers directly.

- I have 3 membership tiers, so 3 plans to choose from.

- I want to bill my customers annually.

- I want to charge sales tax in my home state (Connecticut) only (to start)

- I want to offer a 3-day trial.

- In summary, I want my users to sign up today, get 3 days free, they get billed on day 4 - with sales tax if they’re in CT - and then get auto-billed again a year from now and beyond.

Given the above:

1 -do I need Stripe Connect? I don’t think so. That’s only for marketplace apps, right?

2 - Should I be using v2 or v3 of the Stripe API?

3 - what is Stripe Express? I noticed that when I changed from v2 to v3, using “Subscribe the User to a Plan” in my workflow went from a clean foreground modal to a full page 2-column checkout page. Is the foreground modal not an option with v3? Is that modal what they mean by “Express?”

4 - If I configure and pay for Stripe Tax on the stripe website, can I use it to dynamically calculate sales tax for me using Stripe API? I see how to force the inclusion of a manually defined Tax Rate, but doesn’t Stripe Tax eliminate the need to manually configure Tax Rates?

Thank you in advance!!!

PS - Is there a thread/post/page that distills these options like I’m asking for here? If so, please share, thanks!

Hey @ThatFizzGuy ,

Stripe’s API capabilities are vast, and everyone’s got their own spin on their payment needs, so it can be a bit maze-like to find the exact resources you need for your case with no more and no less. It sounds like you’ve already learned a lot. Here’s answers to your direct questions:

- No, you don’t need Stripe Connect. That’s only if you wanted your app’s users to pay each other, as in a marketplace like you said.

- Use V3. You always want to be on the latest version of any API as much as possible since you know everything will be supported there (not just with Bubble’s built-in plugin but Stripe’s own API endpoints).

- Stripe Express accounts have to do with Connect, so you can ignore this. The full page “Checkout” page is Stripe’s newest and highly improved, hosted payment page. It supports more features like automatic sales tax, displaying line items, etc. If you’re using the Bubble Stripe plugin, stick with V3 to take advantage of this.

- Stripe has an automatic tax collection that you should look into. They’ll auto calculate based on address entered into the checkout: Stripe Tax | Stripe Documentation. Stripe actually has tons of tax-related features. They don’t all need to be enabled – just depends on use case. If you want to start by charging sales tax in CT, then follow the quick “set up” steps in the link above. You shouldn’t need to manually configure rates in your case.

If you need more customization beyond Bubble’s plugin, you can always integrate via the API Connector. That’s a bit more advanced, but you get all the control.

Hope this helps!

–

Cheers, Gaby

Co-Founder at Coaching No Code Apps

Free Bubble Masterclass

Private Help

2 Likes

Thanks, @romanmg ! I appreciate the input and validation of some of the assumptions I’ve been making!

I’ll have to take another look at my Stripe Tax configuration. I saw it working - calculating and applying tax only in CT - when I used a “Payment Link” but so far when I use the workflow from my bubble app and use Subscribe User to Plan, the resulting checkout page (which looks virtually identical to my Payment Link test) is not doing the tax magic unless I configure my workflow step to “Add Tax Rate to checkout” - which I don’t want to do as that would apply my one tax rate (CT) to all purchasers, regardless of location.

Maybe you can just answer one more Q: if I’m using Stripe Tax and it’s configured properly, should I still have to check the box to apply tax rate? Or would I leave that unchecked?

Thanks again!

It’s confusing but Stripe has two ways of collecting tax:

- Stripe Tax: automatic tax collection

- Tax Rates: you create and manage your own tax rates. This is that “txr” ID you see in your screenshot.

You can read about them both here: Collect taxes in Checkout | Stripe Documentation

This checkbox in the Bubble plugin action is specifically for Tax Rates, not Stripe Tax. So, I think what you want is Stripe Tax, so that it’s calculated automatically for you in the generated Checkout page. In other words, leave the checkbox unchecked. You should make sure you have “automatic tax” enabled in your dashboard settings: https://dashboard.stripe.com/settings/tax

1 Like

thanks again @romanmg ! That’s what I thought. Will give it another look!

1 Like

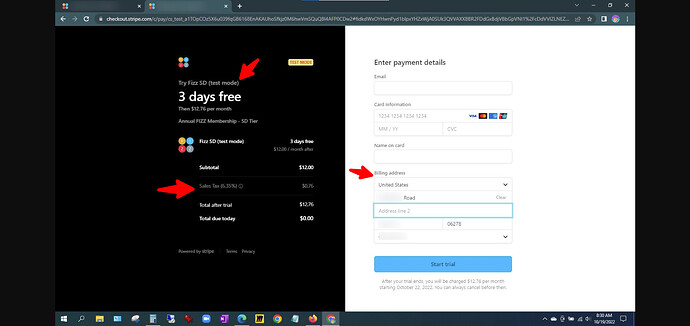

Sorry to be a pest here, but what am I missing? Below are two images.

-The first is what I see when using the Stripe plugin, v3, pointed at my test mode product where I have Stripe Tax configured. No input for address, no sales tax calculation happening.

- The second image is what I see when using the test mode “Payment Link” I created on the Stripe website. Address input appears, sales tax calculation working as expected.

Doesn’t the second image prove I have Stripe Tax configured properly? If so, any thoughts on what I’m missing to make the Bubble plugin work the same as the payment link?

Thanks if you’re able to assist!

Yep, the second screenshot looks right. It’s possible that Bubble’s plugin overrides the auto tax collection setting… possibly. At this point, I’d use the API Connector to create your own Checkout Session with the “automatic tax” parameter included and enabled.

It’s a bit more heavy lifting on your part if you’re not familiar with the API Connector, but it does open up more customization options. If you’re interested in joining our VIP Membership, we’ve actually got a lesson in there that walks you through the whole thing!

Cheers,

Gaby

1 Like

Gotcha, thanks again @romanmg !